When it comes to tracking the performance of the U.S. stock market, few indices are as influential and widely followed as the S&P 500. For investors and financial enthusiasts alike, fintechzoom.com sp500 serves as a go-to resource for real-time updates, analysis, and insights into this critical benchmark. The S&P 500, short for the Standard & Poor’s 500 Index, represents the stock performance of 500 of the largest publicly traded companies in the United States. It’s not just a measure of market health; it’s a barometer of economic trends and investor sentiment. With fintechzoom.com sp500, you can stay ahead of market shifts and make informed decisions.

What makes the S&P 500 so vital for investors? For starters, it’s a market-capitalization-weighted index, meaning companies with larger market values have a greater influence on its movements. This structure ensures that the index reflects the true economic weight of its constituents. Whether you’re a seasoned investor or a novice looking to dip your toes into the stock market, understanding the S&P 500 is essential. Platforms like fintechzoom.com sp500 provide tools, charts, and expert commentary to help you decode the complexities of this index.

But why should you rely on fintechzoom.com sp500 for your market updates? The platform stands out for its user-friendly interface, real-time data, and in-depth analysis. Whether you’re tracking sector performance, analyzing historical trends, or gauging the impact of macroeconomic events, fintechzoom.com sp500 equips you with the information you need. In today’s fast-paced financial world, staying informed is not just an advantage—it’s a necessity. Let’s delve deeper into the intricacies of the S&P 500 and explore how fintechzoom.com sp500 can enhance your investment journey.

Read also:Youraubsome Name Unveiling The Secrets Behind The Name Everyonersquos Talking About

Table of Contents

- What Is the S&P 500?

- Why Does the S&P 500 Matter for Investors?

- How Does fintechzoom.com sp500 Help Investors?

- Key Components of the S&P 500

- How Can You Invest in the S&P 500?

- What Factors Influence the S&P 500?

- Historical Performance of the S&P 500

- FAQs About fintechzoom.com sp500

What Is the S&P 500?

The S&P 500, officially known as the Standard & Poor’s 500 Index, is one of the most widely recognized stock market indices in the world. It tracks the performance of 500 large-cap U.S. companies listed on major exchanges like the New York Stock Exchange (NYSE) and NASDAQ. These companies span various sectors, including technology, healthcare, finance, and consumer goods, providing a comprehensive snapshot of the U.S. economy.

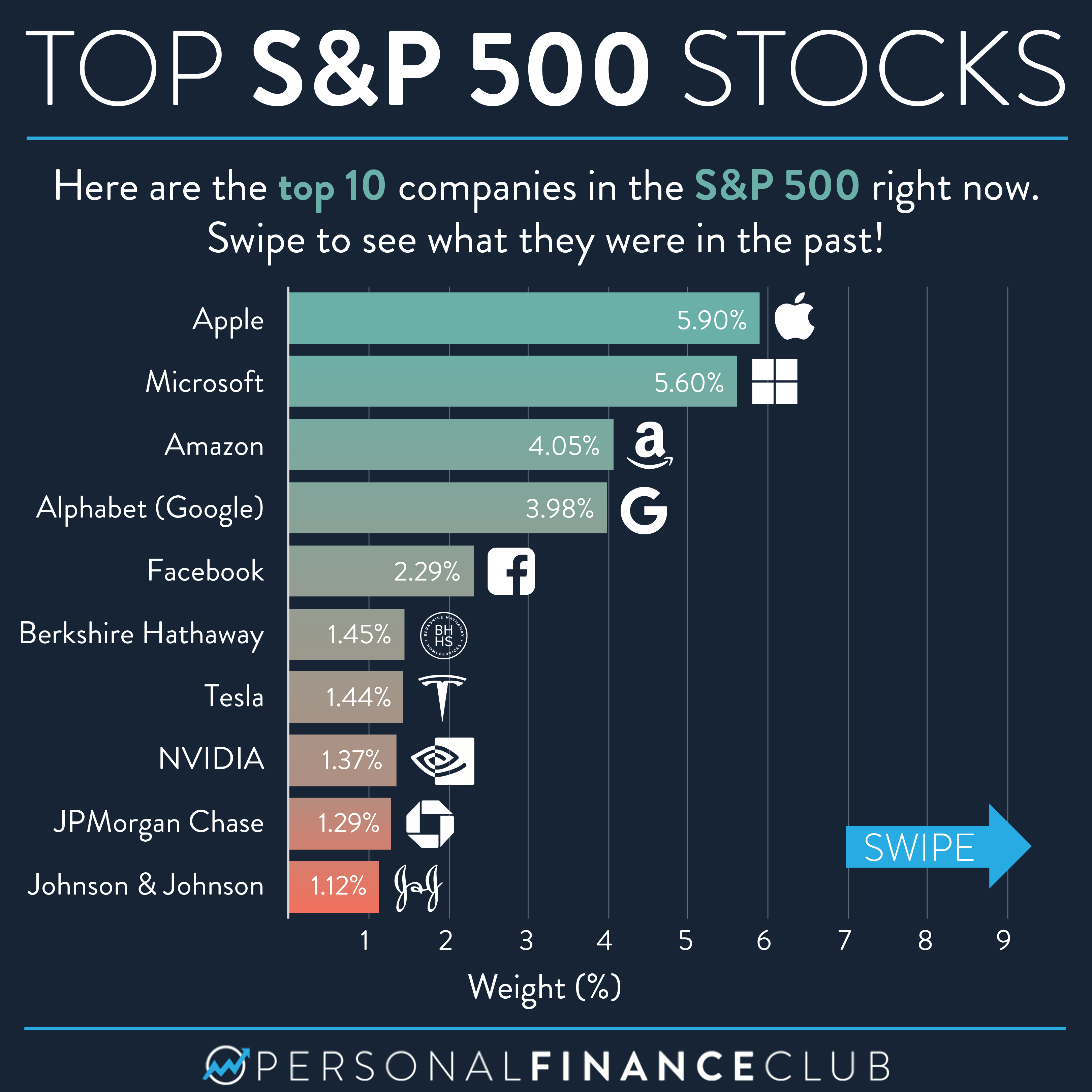

Unlike other indices, such as the Dow Jones Industrial Average (DJIA), which is price-weighted, the S&P 500 is market-capitalization-weighted. This means that companies with higher market values have a greater impact on the index’s performance. For instance, tech giants like Apple, Microsoft, and Amazon often dominate the index due to their massive market caps. This weighting system ensures that the S&P 500 accurately reflects the economic significance of its constituents.

Investors often use the S&P 500 as a benchmark to gauge the overall health of the stock market. Its broad diversification across industries and sectors makes it a reliable indicator of market trends. Additionally, the index is frequently referenced in financial news and reports, making it a staple for anyone interested in the stock market. Platforms like fintechzoom.com sp500 make it easier than ever to track this index, offering real-time updates and expert insights.

Why Does the S&P 500 Matter for Investors?

For investors, the S&P 500 serves as more than just a numerical representation of stock performance—it’s a critical tool for decision-making. The index’s composition of 500 leading companies provides a diversified view of the U.S. economy. By tracking the S&P 500, investors can gain insights into sectoral trends, economic cycles, and market sentiment.

One of the primary reasons the S&P 500 matters is its role as a benchmark. Many investment funds, including mutual funds and exchange-traded funds (ETFs), measure their performance against the S&P 500. If a fund underperforms the index, it may signal issues with its strategy or management. Conversely, outperforming the S&P 500 is often seen as a mark of success for fund managers.

Moreover, the S&P 500’s influence extends beyond individual investors. Institutional investors, policymakers, and economists also rely on the index to assess market conditions. For example, a rising S&P 500 might indicate investor confidence and economic growth, while a declining index could signal uncertainty or potential downturns. With fintechzoom.com sp500, investors can access detailed analyses and forecasts to better understand these dynamics.

Read also:Discover The World Of Lucifer Oyuncular305 Unveiling The Stars Behind The Screen

How Does fintechzoom.com sp500 Help Investors?

In today’s digital age, staying informed about the stock market is easier than ever, thanks to platforms like fintechzoom.com sp500. This resource offers a wealth of tools and features designed to empower investors. From real-time data to expert commentary, fintechzoom.com sp500 provides everything you need to navigate the complexities of the S&P 500.

Real-Time Market Updates

One of the standout features of fintechzoom.com sp500 is its ability to deliver real-time updates. Whether you’re tracking daily price movements or monitoring sector performance, the platform ensures you have access to the latest information. This is particularly valuable for day traders and active investors who rely on timely data to make decisions.

In-Depth Analysis and Commentary

Beyond raw data, fintechzoom.com sp500 offers expert analysis and commentary. Financial experts break down market trends, explain economic indicators, and provide forecasts. This level of insight helps investors understand not just what’s happening in the market, but why it’s happening.

User-Friendly Interface

Another key advantage of fintechzoom.com sp500 is its intuitive design. The platform is easy to navigate, even for beginners. Charts, graphs, and interactive tools make it simple to visualize data and track performance over time. Whether you’re a seasoned investor or just starting out, fintechzoom.com sp500 ensures you can find the information you need quickly and efficiently.

Key Components of the S&P 500

The S&P 500 is composed of 500 companies, each representing a slice of the U.S. economy. These companies are selected based on specific criteria, including market capitalization, liquidity, and financial viability. Understanding the key components of the index can provide valuable insights into its performance and dynamics.

Top Sectors in the S&P 500

The S&P 500 is divided into 11 sectors, with technology, healthcare, and financials often leading the pack. Here’s a breakdown of the top sectors:

- Technology: Companies like Apple, Microsoft, and NVIDIA dominate this sector, driving much of the index’s growth.

- Healthcare: Pharmaceutical giants and biotech firms contribute significantly to the index’s stability.

- Financials: Banks and insurance companies add diversity to the index, reflecting the broader economy.

Notable Companies in the Index

Some of the largest and most influential companies in the world are part of the S&P 500. These include:

- Apple Inc.

- Microsoft Corporation

- Amazon.com Inc.

- Alphabet Inc. (Google)

- Meta Platforms Inc. (Facebook)

These companies not only shape the index’s performance but also influence global markets. Tracking their movements through platforms like fintechzoom.com sp500 can provide valuable insights for investors.

How Can You Invest in the S&P 500?

Investing in the S&P 500 is simpler than ever, thanks to a variety of financial instruments and platforms. Whether you’re looking to buy individual stocks or invest in index funds, there are multiple ways to gain exposure to this benchmark.

Index Funds and ETFs

One of the most popular ways to invest in the S&P 500 is through index funds and exchange-traded funds (ETFs). These funds replicate the index’s performance, offering diversification and low fees. Examples include:

- Vanguard S&P 500 ETF (VOO)

- SPDR S&P 500 ETF Trust (SPY)

- iShares Core S&P 500 ETF (IVV)

Individual Stocks

For investors seeking more control, buying individual stocks of S&P 500 companies is an option. However, this approach requires more research and carries higher risks. Platforms like fintechzoom.com sp500 can help you identify top-performing stocks and analyze their potential.

What Factors Influence the S&P 500?

Several factors can impact the performance of the S&P 500, ranging from economic indicators to geopolitical events. Understanding these influences is crucial for making informed investment decisions.

Economic Indicators

Key economic indicators, such as GDP growth, unemployment rates, and inflation, play a significant role in shaping the S&P 500’s performance. Positive economic data often boosts investor confidence, leading to higher stock prices.

Corporate Earnings

The financial performance of S&P 500 companies directly affects the index. Strong earnings reports can drive stock prices higher, while disappointing results may lead to declines. Monitoring earnings through platforms like fintechzoom.com sp500 can help investors anticipate market movements.

Geopolitical Events

Global events, such as trade tensions, elections, and natural disasters, can also influence the S&P 500. These events create uncertainty, which may lead to market volatility. Staying informed about geopolitical developments is essential for navigating these fluctuations.

Historical Performance of the S&P 500

The S&P 500 has a long history of delivering strong returns, making it a favorite among long-term investors. Over the past century, the index has consistently outperformed other asset classes, such as bonds and commodities.

Key Milestones

Here are some notable milestones in the S&P 500’s history:

- 1957: The index was first introduced, comprising 500 companies.

- 1987: The “Black Monday” crash caused the index to plummet by 20% in a single day.

- 2008: The financial crisis led to a significant decline, but the index rebounded in subsequent years.

- 2020: The COVID-19 pandemic caused a sharp drop, followed by a rapid recovery.

Long-Term Trends

Despite short-term volatility, the S&P 500 has shown resilience over the long term. Historically, the index has delivered average annual returns of around 7-10%. This makes it an attractive option for retirement planning and wealth accumulation.

FAQs About fintechzoom.com sp500

What Is fintechzoom.com sp500?

fintechzoom.com sp500 is a platform that provides