The world of cryptocurrency is evolving rapidly, and one of the most exciting developments is the rise of Bitcoin ETFs, as covered extensively on Fintechzoom.com. Bitcoin ETFs are becoming a hot topic among investors who are looking for a regulated and secure way to gain exposure to the cryptocurrency market. These financial instruments allow investors to trade Bitcoin similarly to how they would trade stocks, offering a bridge between traditional finance and the digital asset ecosystem. Fintechzoom.com has become a reliable source for insights into this growing trend, offering detailed analyses and updates about Bitcoin ETFs.

For those unfamiliar, an ETF (Exchange-Traded Fund) is a type of investment fund that tracks the performance of an underlying asset, in this case, Bitcoin. Unlike directly purchasing Bitcoin, which involves setting up a wallet and managing private keys, Bitcoin ETFs are traded on regulated exchanges. This makes them a more accessible option for institutional and retail investors alike. The coverage on Fintechzoom.com highlights how Bitcoin ETFs are designed to simplify the process of investing in Bitcoin while mitigating some of the risks associated with owning the cryptocurrency outright.

As Bitcoin continues to gain mainstream acceptance, the demand for regulated investment vehicles like Bitcoin ETFs is surging. Fintechzoom.com Bitcoin ETF articles dive into the intricacies of how these ETFs work, their potential benefits, and the challenges they face in gaining regulatory approval. The platform also explores how Bitcoin ETFs could reshape the financial landscape by attracting a broader audience of investors who are hesitant to enter the volatile crypto market directly. This article will provide an in-depth look into the significance of Bitcoin ETFs and why they might just be the next big thing in fintech.

Read also:Perfecting Steak Medium Temp A Comprehensive Guide To Juicy Flavorful Steaks

Table of Contents

- What is a Bitcoin ETF and Why Should You Care?

- How Does Fintechzoom.com Bitcoin ETF Work?

- What Are the Benefits of Investing in a Bitcoin ETF?

- What Are the Risks and Challenges of Bitcoin ETFs?

- How Is the Regulatory Landscape Shaping Bitcoin ETFs?

- Which Bitcoin ETFs Are Leading the Market?

- What Does the Future Hold for Bitcoin ETFs?

- Frequently Asked Questions About Fintechzoom.com Bitcoin ETF

What is a Bitcoin ETF and Why Should You Care?

Before diving into the specifics, it’s essential to understand what a Bitcoin ETF is and why it has captured the attention of both retail and institutional investors. A Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin, allowing investors to gain exposure to the cryptocurrency without owning it directly. This is particularly appealing for those who are interested in the potential upside of Bitcoin but are wary of the technical complexities and security risks associated with holding the asset.

One of the key reasons Bitcoin ETFs are gaining traction is their accessibility. Traditional investment vehicles like stocks and bonds have long been the go-to options for investors. However, the emergence of Bitcoin ETFs offers a new avenue for diversification. By trading Bitcoin ETFs on regulated exchanges, investors can avoid the hassle of managing private keys or dealing with cryptocurrency exchanges. This convenience is a significant draw for those who are new to the crypto space or prefer a more hands-off approach.

Moreover, Bitcoin ETFs are designed to provide liquidity and transparency. Unlike direct Bitcoin investments, which can be subject to high volatility and limited trading hours on certain exchanges, Bitcoin ETFs are traded during regular market hours. This ensures that investors can buy and sell shares with ease. Additionally, the regulatory oversight associated with ETFs adds a layer of trust, making them a more appealing option for risk-averse investors. As Fintechzoom.com Bitcoin ETF coverage suggests, these factors combined make Bitcoin ETFs a compelling choice for those looking to diversify their portfolios.

How Does Fintechzoom.com Bitcoin ETF Work?

Fintechzoom.com provides a wealth of information on how Bitcoin ETFs operate, breaking down the mechanics in a way that’s easy to understand. At its core, a Bitcoin ETF functions similarly to other ETFs but with a focus on tracking the price of Bitcoin. The ETF issuer holds a certain amount of Bitcoin or Bitcoin futures contracts, which serve as the underlying asset. The value of the ETF shares fluctuates based on the price movements of Bitcoin, allowing investors to speculate on its performance without owning the cryptocurrency itself.

Understanding the Structure

There are two primary types of Bitcoin ETFs: physically-backed and futures-based. Physically-backed Bitcoin ETFs hold actual Bitcoin in reserve, meaning the ETF’s value is directly tied to the cryptocurrency’s market price. On the other hand, futures-based Bitcoin ETFs rely on Bitcoin futures contracts, which are agreements to buy or sell Bitcoin at a predetermined price at a future date. Both types have their advantages and drawbacks, which Fintechzoom.com Bitcoin ETF articles explore in detail.

Trading and Liquidity

Bitcoin ETFs are traded on traditional stock exchanges, such as the NYSE or NASDAQ, making them highly liquid. Investors can buy and sell shares just like they would with any other stock, providing a seamless experience. This liquidity is a significant advantage over direct Bitcoin investments, which can sometimes face delays due to network congestion or limited exchange availability. Fintechzoom.com highlights how this feature makes Bitcoin ETFs an attractive option for traders looking to capitalize on short-term price movements.

Read also:Unlocking The Power Of Yahoomailcok A Comprehensive Guide

What Are the Benefits of Investing in a Bitcoin ETF?

Investing in a Bitcoin ETF offers several advantages that make it an appealing option for both novice and experienced investors. One of the most significant benefits is the ease of access. Unlike purchasing Bitcoin directly, which requires setting up a digital wallet and navigating cryptocurrency exchanges, Bitcoin ETFs can be bought and sold through traditional brokerage accounts. This simplicity removes many of the barriers to entry that have historically deterred investors from entering the crypto market.

Diversification and Risk Management

Another key benefit is the ability to diversify your investment portfolio. Bitcoin ETFs allow investors to gain exposure to the cryptocurrency market without putting all their eggs in one basket. By including Bitcoin ETFs in a broader portfolio that includes stocks, bonds, and other assets, investors can mitigate risk while still capitalizing on the potential upside of Bitcoin. Fintechzoom.com Bitcoin ETF resources emphasize how this diversification can enhance overall portfolio performance.

Regulatory Oversight and Security

Bitcoin ETFs are subject to regulatory oversight, which adds a layer of security and trust. This is particularly important in the cryptocurrency space, where scams and fraud are prevalent. By investing in a regulated product like a Bitcoin ETF, investors can have peace of mind knowing that their funds are protected by stringent compliance measures. Fintechzoom.com Bitcoin ETF articles frequently highlight how this regulatory framework makes Bitcoin ETFs a safer option compared to direct cryptocurrency investments.

What Are the Risks and Challenges of Bitcoin ETFs?

While Bitcoin ETFs offer numerous benefits, they are not without risks and challenges. One of the primary concerns is the volatility of the underlying asset, Bitcoin. As a highly volatile cryptocurrency, Bitcoin’s price can fluctuate dramatically in a short period, which directly impacts the value of the ETF. This volatility can lead to significant gains but also poses the risk of substantial losses, making it essential for investors to approach Bitcoin ETFs with caution.

Regulatory Hurdles

Another challenge is the regulatory landscape. Bitcoin ETFs must receive approval from financial regulators, such as the SEC in the United States, before they can be listed on exchanges. This process can be lengthy and complex, with many applications facing rejection due to concerns about market manipulation and investor protection. Fintechzoom.com Bitcoin ETF coverage often discusses how regulatory hurdles can delay the launch of new Bitcoin ETFs, impacting investor confidence.

Tracking Errors and Fees

Investors should also be aware of potential tracking errors and fees associated with Bitcoin ETFs. Tracking errors occur when the ETF’s performance does not perfectly align with the price of Bitcoin, which can happen due to management fees or inefficiencies in the fund’s structure. Additionally, Bitcoin ETFs typically charge management fees, which can eat into returns over time. Fintechzoom.com Bitcoin ETF resources provide insights into how these factors can affect the overall profitability of investing in Bitcoin ETFs.

How Is the Regulatory Landscape Shaping Bitcoin ETFs?

The regulatory environment plays a crucial role in the development and adoption of Bitcoin ETFs. In recent years, there has been a growing push for regulatory clarity in the cryptocurrency space, with financial authorities around the world grappling with how to oversee these new financial products. The SEC, for example, has been particularly cautious, rejecting several Bitcoin ETF applications due to concerns about market manipulation and the lack of transparency in the cryptocurrency market.

Recent Developments

Despite these challenges, there have been some positive developments. In 2021, the SEC approved the first Bitcoin futures ETF, marking a significant milestone for the industry. This approval paved the way for other Bitcoin ETFs to enter the market, although physically-backed ETFs are still awaiting regulatory approval. Fintechzoom.com Bitcoin ETF articles provide updates on these developments, offering insights into how the regulatory landscape is evolving and what it means for investors.

Global Perspectives

Outside the United States, other countries have taken a more progressive approach to Bitcoin ETFs. Canada, for instance, has approved several Bitcoin ETFs, allowing investors in the region to gain exposure to the cryptocurrency through regulated channels. Similarly, European regulators have shown a willingness to embrace Bitcoin ETFs, with several products already available on exchanges. Fintechzoom.com Bitcoin ETF coverage explores these global perspectives, highlighting how different regulatory approaches are shaping the future of Bitcoin ETFs.

Which Bitcoin ETFs Are Leading the Market?

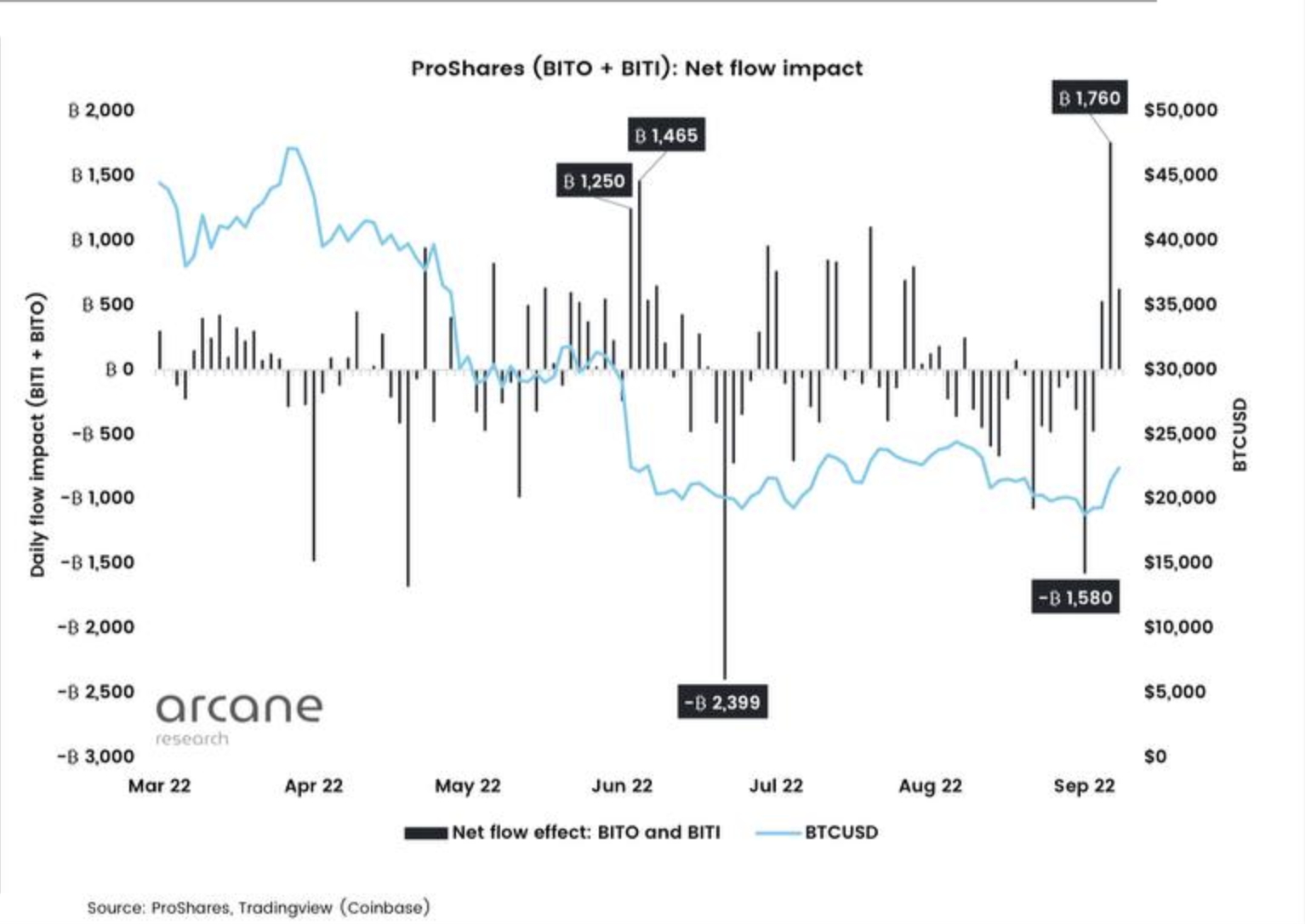

As the demand for Bitcoin ETFs continues to grow, several products have emerged as leaders in the market. One of the most notable is the ProShares Bitcoin Strategy ETF, which was the first Bitcoin futures ETF to receive SEC approval. This ETF tracks the performance of Bitcoin futures contracts and has gained significant traction among investors looking for regulated exposure to Bitcoin. Fintechzoom.com Bitcoin ETF resources provide detailed comparisons of leading Bitcoin ETFs, helping investors make informed decisions.

Key Players

Other prominent Bitcoin ETFs include the Valkyrie Bitcoin Strategy ETF and the VanEck Bitcoin Strategy ETF. These products offer similar features, such as exposure to Bitcoin futures and trading on regulated exchanges. However, each ETF has its own unique characteristics, such as management fees and tracking accuracy, which can impact performance. Fintechzoom.com Bitcoin ETF articles analyze these differences, offering insights into which ETFs might be the best fit for different types of investors.

Performance Metrics

When comparing Bitcoin ETFs, it’s essential to consider performance metrics such as expense ratios, tracking error, and liquidity. These factors can significantly affect the overall returns and ease of trading. Fintechzoom.com Bitcoin ETF coverage provides data-driven analyses of these metrics, helping investors evaluate the strengths and weaknesses of each product. By understanding these performance indicators, investors can choose the Bitcoin ETF that aligns with their investment goals.

What Does the Future Hold for Bitcoin ETFs?

The future of Bitcoin ETFs looks promising, with increasing interest from both retail and institutional investors. As regulatory frameworks continue to evolve, the likelihood of more Bitcoin ETFs receiving approval is high. This could lead to a surge in adoption, as more investors seek regulated and accessible ways to gain exposure to Bitcoin. Fintechzoom.com Bitcoin ETF articles explore these trends, offering predictions about how the market might develop in the coming years.

Technological Advancements

Technological advancements are also expected to play a significant role in the future of Bitcoin ETFs. Innovations such as blockchain technology and smart contracts could enhance the efficiency and transparency of these financial products. Fintechzoom.com Bitcoin ETF resources discuss how these advancements could improve the performance and security of Bitcoin ETFs, making them even more appealing to investors.

Mainstream Adoption

As Bitcoin ETFs become more mainstream, they have the potential to attract a broader audience of investors. This increased adoption could drive up the price of Bitcoin, creating a positive feedback loop that benefits both the cryptocurrency and the ETF market. Fintechzoom.com Bitcoin ETF coverage highlights how this trend could reshape the financial landscape, paving the way for a new era of digital asset investing.

Frequently Asked Questions About Fintechzoom.com Bitcoin ETF

What is the difference between a Bitcoin ETF and buying Bitcoin directly?

A Bitcoin ETF allows investors to gain exposure to Bitcoin’s price movements without owning the cryptocurrency directly. This eliminates the need for managing private keys or using