Are you looking to navigate the dynamic world of exchange-traded funds (ETFs) and seeking insights into how Fintechzoom Com ETF Market Vanguard can help you make informed decisions? Look no further! Fintechzoom has emerged as a leading platform for investors, offering up-to-date market analysis, trends, and tools to maximize returns. Vanguard, a household name in the investment world, is synonymous with low-cost ETFs and a commitment to long-term wealth creation. Together, these two powerhouses provide a robust framework for understanding the ETF landscape. Whether you're a seasoned investor or just starting, this guide will walk you through everything you need to know about leveraging Fintechzoom Com ETF Market Vanguard to achieve your financial goals.

In today's fast-paced financial environment, staying ahead of the curve is essential. Fintechzoom Com ETF Market Vanguard is not just a resource; it's a gateway to smarter investing. With its user-friendly interface and real-time data, Fintechzoom empowers investors to track Vanguard's ETFs, analyze performance metrics, and identify emerging opportunities. The platform's comprehensive coverage of Vanguard ETFs ensures that you have access to reliable information, enabling you to make data-driven decisions. From understanding the basics of ETFs to exploring advanced strategies, this article will equip you with the knowledge to thrive in the ETF market.

As we dive deeper into the intricacies of Fintechzoom Com ETF Market Vanguard, you'll discover how this powerful combination can enhance your investment strategy. Whether you're interested in diversifying your portfolio, minimizing costs, or maximizing returns, Fintechzoom and Vanguard have got you covered. In the sections that follow, we'll explore the features of Fintechzoom, the benefits of Vanguard ETFs, and how you can use these tools to build a resilient financial future. So, buckle up as we embark on this journey to unlock the full potential of Fintechzoom Com ETF Market Vanguard!

Read also:Who Is Genae Angelique Crump Discovering Her Inspiring Journey And Achievements

Table of Contents

- What is Fintechzoom Com ETF Market Vanguard?

- Why Should You Consider Vanguard ETFs?

- How Can Fintechzoom Help You Track ETFs?

- What Are the Benefits of Diversifying with ETFs?

- How to Build a Successful ETF Investment Strategy?

- Can Fintechzoom Com ETF Market Vanguard Reduce Investment Costs?

- What Are the Risks Associated with ETF Investing?

- FAQs About Fintechzoom Com ETF Market Vanguard

What is Fintechzoom Com ETF Market Vanguard?

Fintechzoom Com ETF Market Vanguard is a powerful resource for investors seeking to explore the vast world of exchange-traded funds (ETFs). At its core, Fintechzoom is a financial technology platform designed to provide users with real-time market data, in-depth analysis, and actionable insights. When paired with Vanguard's renowned ETF offerings, this platform becomes an indispensable tool for anyone looking to make informed investment decisions.

Vanguard, a pioneer in the ETF space, is known for its low-cost, high-quality funds that cater to a wide range of investors. The company's commitment to transparency and long-term growth aligns perfectly with Fintechzoom's mission to empower investors with knowledge. Together, they create a synergy that allows users to track Vanguard ETFs, analyze performance metrics, and identify trends that can shape their investment strategies.

Whether you're a beginner or an experienced investor, Fintechzoom Com ETF Market Vanguard offers a wealth of features to enhance your investment journey. From customizable dashboards to advanced charting tools, the platform ensures that you have access to the information you need to succeed. By leveraging this combination, you can stay ahead of market trends, minimize risks, and maximize returns.

Key Features of Fintechzoom

- Real-time market data and analysis

- Customizable dashboards for personalized insights

- Advanced charting tools for technical analysis

- Comprehensive coverage of Vanguard ETFs

- User-friendly interface for seamless navigation

Why Should You Consider Vanguard ETFs?

Vanguard ETFs have earned a reputation for being some of the best investment vehicles available in the market. But what makes them stand out from the crowd? For starters, Vanguard is known for its low expense ratios, which can significantly reduce the cost of investing over time. This cost advantage allows investors to keep more of their returns, making Vanguard ETFs an attractive option for long-term wealth creation.

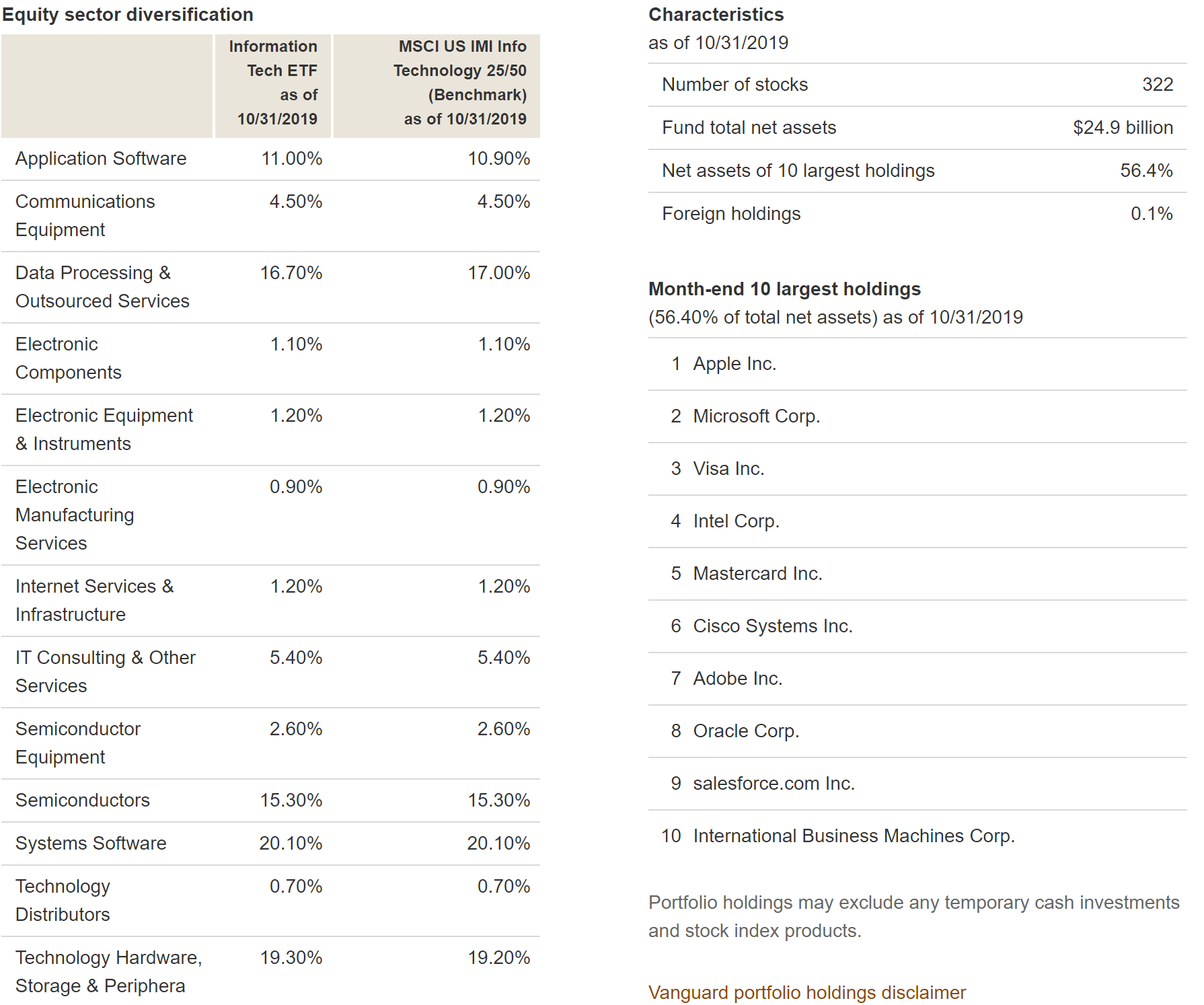

Another key benefit of Vanguard ETFs is their focus on diversification. By investing in a single Vanguard ETF, you can gain exposure to a wide range of assets, sectors, or even global markets. This diversification helps mitigate risks and ensures that your portfolio is not overly reliant on any single investment. Additionally, Vanguard ETFs are designed to track specific indices, providing a passive investment approach that aligns with the principles of index investing.

Furthermore, Vanguard's commitment to transparency and investor education sets it apart from other fund providers. The company provides detailed information about its ETFs, including holdings, performance metrics, and expense ratios. This transparency allows investors to make informed decisions and align their investments with their financial goals.

Read also:Unlock Your Writing Potential With Https Join Wewillwrite Com A Comprehensive Guide

Why Vanguard ETFs Are Ideal for Long-Term Investors

- Low expense ratios reduce long-term investment costs

- Diversification minimizes risks and enhances stability

- Passive investment approach aligns with index investing principles

- Transparency ensures informed decision-making

How Can Fintechzoom Help You Track ETFs?

Fintechzoom is more than just a financial news platform; it's a comprehensive tool for tracking and analyzing ETFs. With its robust features and intuitive design, Fintechzoom makes it easy for investors to stay on top of their investments. Whether you're monitoring Vanguard ETFs or exploring other options, Fintechzoom provides the tools you need to succeed.

One of the standout features of Fintechzoom is its real-time market data. This allows users to track the performance of their ETFs as it happens, ensuring that they are always up-to-date with the latest trends. Additionally, Fintechzoom offers customizable dashboards, enabling investors to tailor their experience to their specific needs. Whether you're interested in technical analysis or fundamental metrics, Fintechzoom has you covered.

Another key advantage of Fintechzoom is its advanced charting tools. These tools allow investors to conduct in-depth technical analysis, identify trends, and make data-driven decisions. With Fintechzoom, you can visualize your ETF performance, compare it against benchmarks, and gain insights that can inform your investment strategy.

Benefits of Using Fintechzoom for ETF Tracking

- Real-time data ensures timely decision-making

- Customizable dashboards cater to individual preferences

- Advanced charting tools for technical analysis

- Comprehensive coverage of ETFs, including Vanguard

What Are the Benefits of Diversifying with ETFs?

Diversification is a cornerstone of successful investing, and ETFs offer a unique way to achieve it. By investing in a single ETF, you can gain exposure to a wide range of assets, sectors, or even global markets. This diversification helps spread risk and ensures that your portfolio is not overly reliant on any single investment.

Vanguard ETFs, in particular, are designed to provide broad market exposure. Whether you're interested in U.S. equities, international markets, or specific sectors, Vanguard offers a wide range of ETFs to suit your needs. This broad exposure allows investors to build a diversified portfolio that aligns with their financial goals.

Another benefit of diversifying with ETFs is the ability to minimize volatility. By spreading your investments across multiple assets, you can reduce the impact of market fluctuations on your portfolio. This stability is particularly important for long-term investors who are focused on steady growth over time.

How Diversification Enhances Portfolio Stability

- Reduces reliance on individual investments

- Minimizes the impact of market volatility

- Aligns with long-term growth objectives

How to Build a Successful ETF Investment Strategy?

Building a successful ETF investment strategy requires careful planning and a clear understanding of your financial goals. One of the first steps is to determine your investment objectives. Are you looking for long-term growth, income generation, or a combination of both? Once you have a clear goal in mind, you can start exploring ETFs that align with your objectives.

Another important consideration is risk tolerance. ETFs offer a wide range of options, from conservative funds to more aggressive growth-oriented options. Understanding your risk tolerance will help you select ETFs that match your comfort level. Additionally, it's important to consider factors such as expense ratios, liquidity, and tracking error when evaluating ETFs.

Finally, a successful ETF strategy requires regular monitoring and adjustments. Markets are constantly evolving, and your investment strategy should evolve with them. By using tools like Fintechzoom Com ETF Market Vanguard, you can stay informed about market trends and make adjustments to your portfolio as needed.

Steps to Build an Effective ETF Strategy

- Define your investment objectives

- Assess your risk tolerance

- Evaluate ETFs based on expense ratios and liquidity

- Monitor and adjust your portfolio regularly

Can Fintechzoom Com ETF Market Vanguard Reduce Investment Costs?

One of the key advantages of using Fintechzoom Com ETF Market Vanguard is its ability to reduce investment costs. Vanguard ETFs are known for their low expense ratios, which can significantly lower the cost of investing over time. By using Fintechzoom to track and analyze these ETFs, investors can identify cost-effective options that align with their financial goals.

Additionally, Fintechzoom's real-time data and advanced tools allow investors to make informed decisions that minimize costs. For example, by using the platform's charting tools, investors can identify trends and opportunities that can enhance their returns. This data-driven approach ensures that investors are not only reducing costs but also maximizing their potential for growth.

Finally, Fintechzoom's transparency and educational resources empower investors to make smarter decisions. By understanding the factors that impact investment costs, such as expense ratios and trading fees, investors can build a cost-effective portfolio that aligns with their long-term objectives.

How Fintechzoom Helps Minimize Investment Costs

- Low-cost Vanguard ETFs reduce expense ratios

- Real-time data ensures informed decision-making

- Educational resources empower cost-effective investing

What Are the Risks Associated with ETF Investing?

While ETFs offer numerous benefits, it's important to be aware of the risks involved. One of the primary risks is market volatility. ETFs are subject to the same fluctuations as the underlying assets they track, which can lead to significant price swings. This volatility can be particularly pronounced in niche or sector-specific ETFs.

Another risk to consider is tracking error. While ETFs are designed to track specific indices, there can be discrepancies between the ETF's performance and the index it tracks. These discrepancies, known as tracking errors, can impact returns and should be carefully monitored.

Finally, liquidity risk is another factor to consider. Some ETFs may have lower trading volumes, making it difficult to buy or sell shares at desired prices. By using tools like Fintechzoom Com ETF Market Vanguard, investors can assess liquidity and make informed decisions to mitigate these risks.

Common Risks of ETF Investing

- Market volatility can impact returns

- Tracking errors may lead to discrepancies

- Liquidity risk affects trading flexibility

FAQs About Fintechzoom Com ETF Market Vanguard

What Makes Fintechzoom Com ETF Market Vanguard