The FintechZoom.com FTSE 100 serves as a critical benchmark for the UK's financial markets, reflecting the performance of the top 100 companies listed on the London Stock Exchange. Investors, analysts, and financial enthusiasts frequently turn to this index to gauge the health of the UK economy and make informed decisions. With its dynamic nature, the FTSE 100 not only represents a snapshot of the corporate landscape but also offers a window into global economic trends. Whether you're a seasoned investor or a curious beginner, understanding the FTSE 100 is essential for navigating the financial world.

For those seeking reliable insights, FintechZoom.com has become a trusted platform, offering real-time updates, expert analysis, and actionable data on the FTSE 100. The index's composition includes some of the largest and most influential companies across various sectors, such as banking, energy, and consumer goods. This diversity makes it a vital tool for tracking market movements and identifying opportunities. By leveraging FintechZoom.com's resources, users can stay ahead of market trends and make decisions that align with their financial goals.

As global markets continue to evolve, the FintechZoom.com FTSE 100 remains a cornerstone of financial analysis. Its fluctuations are influenced by geopolitical events, economic indicators, and corporate earnings, making it a barometer of both domestic and international economic health. Investors who grasp the nuances of this index can position themselves strategically to capitalize on market shifts. In this article, we will explore the intricacies of the FTSE 100, its role in the financial ecosystem, and how platforms like FintechZoom.com empower users to stay informed and make smarter investment choices.

Read also:Exploring Fernaflos Net Worth The Journey Of A Rising Star

Table of Contents

- What Is the FTSE 100 and Why Does It Matter?

- How Does FintechZoom.com Enhance FTSE 100 Analysis?

- Who Are the Top Companies in the FTSE 100?

- How to Invest in the FTSE 100: A Step-by-Step Guide

- What Factors Influence the FTSE 100's Performance?

- Is the FTSE 100 a Good Investment for Beginners?

- How to Track the FTSE 100 on FintechZoom.com

- Frequently Asked Questions About FintechZoom.com FTSE 100

What Is the FTSE 100 and Why Does It Matter?

The FTSE 100, often referred to as the "Footsie," is a stock market index that tracks the performance of the 100 largest companies by market capitalization listed on the London Stock Exchange. Established in 1984, it serves as a barometer for the UK economy and is widely regarded as one of the most important indices in the world. The FTSE 100 includes companies from a diverse range of sectors, such as finance, energy, healthcare, and consumer goods, making it a reflection of the broader economic landscape.

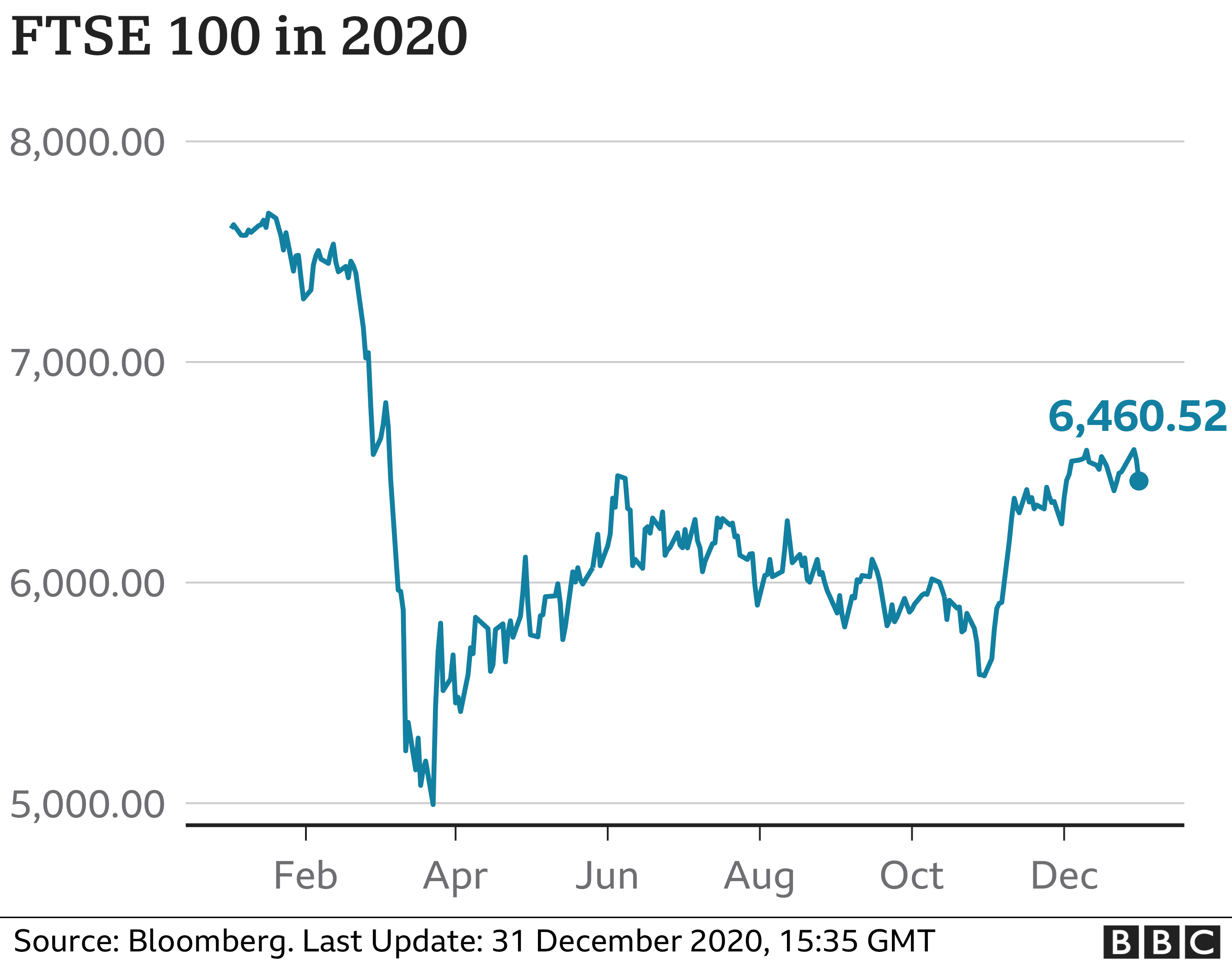

Investors pay close attention to the FTSE 100 because it provides valuable insights into market trends and economic health. For instance, when the index rises, it often signals optimism about the future performance of the companies within it and the economy as a whole. Conversely, a decline in the index can indicate potential challenges, such as geopolitical tensions, economic slowdowns, or sector-specific issues. This makes the FTSE 100 a critical tool for both institutional and retail investors who want to make informed decisions.

Another reason the FTSE 100 matters is its global influence. Many of the companies listed on the index are multinational corporations with operations spanning continents. For example, giants like BP, Unilever, and HSBC have a significant presence in international markets, meaning their performance can impact global economies. This interconnectedness makes the FTSE 100 a key indicator not just for the UK but for global investors as well. By understanding its movements, investors can identify opportunities and risks in both domestic and international markets.

How Does FintechZoom.com Enhance FTSE 100 Analysis?

FintechZoom.com has emerged as a leading platform for financial enthusiasts and investors seeking in-depth analysis of the FTSE 100. The platform's user-friendly interface and robust tools make it easier for users to track market trends, analyze stock performance, and stay updated on breaking news. One of the standout features of FintechZoom.com is its real-time data feeds, which provide up-to-the-minute information on the FTSE 100's movements. This ensures that users are always equipped with the latest insights to make timely decisions.

What Makes FintechZoom.com Stand Out?

Several factors set FintechZoom.com apart from other financial platforms. First, its comprehensive coverage of the FTSE 100 includes not only stock prices but also expert commentary and market forecasts. This combination of data and analysis helps users understand the "why" behind market movements, not just the "what." Additionally, FintechZoom.com offers customizable dashboards, allowing users to tailor their experience based on their investment goals and preferences. Whether you're interested in specific sectors or want a holistic view of the index, the platform caters to all needs.

How Does FintechZoom.com Use Technology to Simplify FTSE 100 Analysis?

FintechZoom.com leverages cutting-edge technology to simplify complex financial data. For instance, its AI-driven algorithms can identify patterns and trends within the FTSE 100, providing users with actionable insights. The platform also offers advanced charting tools, enabling users to visualize data and spot potential opportunities or risks. Moreover, FintechZoom.com's mobile app ensures that users can access critical information on the go, making it a convenient choice for busy investors.

Read also:Who Is Angela Halilis Boyfriend John Everything You Need To Know

Another key feature is the platform's educational resources. FintechZoom.com offers articles, webinars, and tutorials designed to help users deepen their understanding of the FTSE 100 and broader financial markets. These resources are particularly beneficial for beginners who may feel overwhelmed by the complexities of stock market analysis. By combining technology, expert insights, and educational tools, FintechZoom.com empowers users to navigate the FTSE 100 with confidence.

Who Are the Top Companies in the FTSE 100?

The FTSE 100 is home to some of the most prominent and influential companies in the world. These corporations not only drive the UK economy but also have a significant global presence. Below is a table highlighting key details about some of the top companies in the FTSE 100, including their sectors and market capitalizations.

| Company Name | Sector | Market Cap (Approx.) | Headquarters |

|---|---|---|---|

| BP plc | Energy | $100 billion | London, UK |

| Unilever plc | Consumer Goods | $120 billion | London, UK |

| HSBC Holdings plc | Financial Services | $110 billion | London, UK |

| GlaxoSmithKline plc | Healthcare | $85 billion | Brentford, UK |

| Shell plc | Energy | $200 billion | The Hague, Netherlands |

These companies are not only leaders in their respective industries but also play a crucial role in shaping the FTSE 100's performance. For example, energy giants like BP and Shell are heavily influenced by global oil prices, which can significantly impact the index. Similarly, consumer goods companies like Unilever often reflect consumer sentiment and spending patterns, providing insights into economic health. Understanding these dynamics is essential for anyone looking to invest in or analyze the FTSE 100.

How to Invest in the FTSE 100: A Step-by-Step Guide

Investing in the FTSE 100 can be a rewarding venture, offering exposure to some of the largest and most stable companies in the UK. However, navigating the process requires careful planning and a clear understanding of the steps involved. Below, we outline a step-by-step guide to help you get started on your investment journey.

Step 1: Choose the Right Investment Vehicle

There are several ways to invest in the FTSE 100, each with its own advantages and considerations. The most common options include:

- Exchange-Traded Funds (ETFs): ETFs are a popular choice for beginners because they offer diversified exposure to the entire FTSE 100 index. This reduces the risk associated with investing in individual stocks.

- Index Funds: Similar to ETFs, index funds track the performance of the FTSE 100 but are typically managed by financial institutions. They often have lower fees compared to actively managed funds.

- Individual Stocks: For those seeking higher returns, investing directly in individual FTSE 100 companies can be lucrative. However, this approach requires more research and carries higher risk.

Step 2: Open a Brokerage Account

To invest in the FTSE 100, you'll need to open a brokerage account. Many online platforms, such as FintechZoom.com, offer user-friendly interfaces and low fees, making it easier for beginners to get started. When choosing a broker, consider factors like trading fees, account minimums, and available research tools. For example, platforms that provide real-time data and expert analysis can help you make informed decisions.

Step 3: Develop an Investment Strategy

Once your account is set up, it's time to develop a strategy tailored to your financial goals. Ask yourself: Are you investing for long-term growth, or are you seeking short-term gains? Your answer will influence the types of investments you choose and the level of risk you're willing to take. For instance, a long-term investor might focus on ETFs or blue-chip stocks, while a short-term trader may opt for individual stocks with higher volatility.

Step 4: Monitor and Rebalance Your Portfolio

Investing in the FTSE 100 is not a "set it and forget it" endeavor. Regularly monitoring your portfolio is essential to ensure it aligns with your goals. Use platforms like FintechZoom.com to track performance and stay updated on market trends. Additionally, rebalancing your portfolio periodically can help mitigate risk and optimize returns. For example, if one sector becomes overrepresented due to market movements, you may want to reallocate your investments to maintain diversification.

By following these steps, you can confidently invest in the FTSE 100 and take advantage of the opportunities it offers. Whether you're a novice or an experienced investor, the key is to stay informed and adapt to changing market conditions.

What Factors Influence the FTSE 100's Performance?

The performance of the FTSE 100 is influenced by a variety of factors, ranging from economic indicators to geopolitical events. Understanding these drivers is crucial for investors looking to anticipate market movements and make informed decisions. Below, we explore the key factors that impact the FTSE 100 and their implications for investors.

How Do Economic Indicators Affect the FTSE 100?

Economic indicators such as GDP growth, inflation rates, and unemployment figures play a significant role in shaping the FTSE 100's performance. For instance, strong GDP growth often signals a healthy economy, which can boost investor confidence and drive the index higher. Conversely, high inflation or rising unemployment can create uncertainty, leading to a decline in